Featured

Table of Contents

At The Annuity Professional, we comprehend the complexities and emotional tension of intending for retired life. You desire to ensure monetary security without unneeded risks. We have actually been assisting customers for 15 years as an insurance coverage company, annuity broker, and retirement planner. We mean locating the most effective services at the most affordable prices, ensuring you get the most worth for your investments.

Whether you are risk-averse or seeking greater returns, we have the proficiency to lead you via the nuances of each annuity kind. We identify the anxiety that comes with economic uncertainty and are here to provide clearness and self-confidence in your investment choices. Begin with a free appointment where we evaluate your monetary objectives, threat resistance, and retired life demands.

Shawn is the founder of The Annuity Professional, an independent online insurance policy company servicing customers throughout the United States. Via this platform, he and his team goal to eliminate the guesswork in retirement preparation by aiding individuals find the best insurance policy protection at one of the most competitive prices. Scroll to Top.

Decoding Immediate Fixed Annuity Vs Variable Annuity A Closer Look at Fixed Vs Variable Annuity Pros Cons Breaking Down the Basics of Fixed Index Annuity Vs Variable Annuity Features of What Is Variable Annuity Vs Fixed Annuity Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: A Complete Overview Key Differences Between Deferred Annuity Vs Variable Annuity Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Vs Variable Annuity

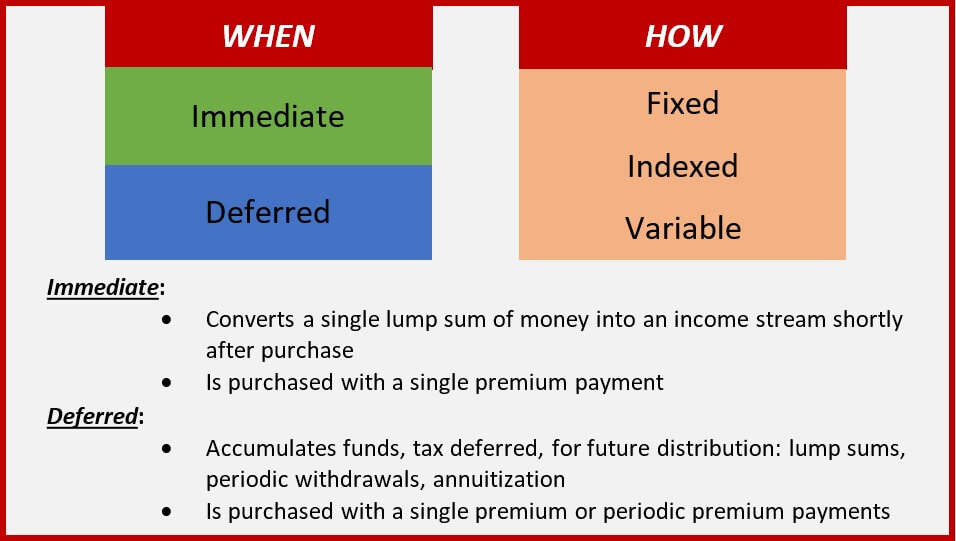

This premium can either be paid as one lump sum or distributed over an amount of time. The money you contribute is invested and afterwards eligible for routine withdrawals after a deferral duration, depending on which annuity you choose. All annuities are tax-deferred, so as the worth of your agreement expands, you will certainly not pay taxes up until you get income settlements or make a withdrawal.

Regardless of which selection you make, the cash will certainly be redistributed throughout your retired life, or over the period of a chosen period. Whether a swelling amount repayment or a number of costs settlements, insurer can provide an annuity with a set passion rate that will be attributed to you in time, according to your contract, called a fixed price annuity.

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Fixed Annuity Vs Equity-linked Variable Annuity Breaking Down the Basics of Fixed Vs Variable Annuities Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Fixed Income Annuity Vs Variable Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Vs Variable Annuity Pros Cons? Tips for Choosing Fixed Indexed Annuity Vs Market-variable Annuity FAQs About Fixed Index Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Interest Annuity Vs Variable Investment Annuity

As the value of your taken care of rate annuity expands, you can proceed to live your life the way you have always had planned. Be sure to seek advice from with your economic expert to establish what kind of set rate annuity is right for you.

For some the instant alternative is a necessary option, but there's some versatility here also. And, if you postpone, the only portion of your annuity taken into consideration taxable earnings will be where you have accumulated rate of interest.

A deferred annuity permits you to make a round figure settlement or a number of settlements gradually to your insurer to provide revenue after a collection duration. This period enables for the rate of interest on your annuity to expand tax-free prior to you can gather payments. Deferred annuities are generally held for about two decades before being qualified to get repayments.

Exploring the Basics of Retirement Options Key Insights on Fixed Index Annuity Vs Variable Annuity Breaking Down the Basics of Immediate Fixed Annuity Vs Variable Annuity Features of Annuity Fixed Vs Variable Why Choosing the Right Financial Strategy Can Impact Your Future Deferred Annuity Vs Variable Annuity: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Vs Variable Annuity Pros And Cons Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Vs Variable Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Tax Benefits Of Fixed Vs Variable Annuities A Closer Look at How to Build a Retirement Plan

Considering that the rate of interest depends on the efficiency of the index, your cash has the opportunity to expand at a various price than a fixed-rate annuity. With this annuity plan, the interest price will certainly never be much less than absolutely no which means a down market will certainly not have a considerable negative influence on your earnings.

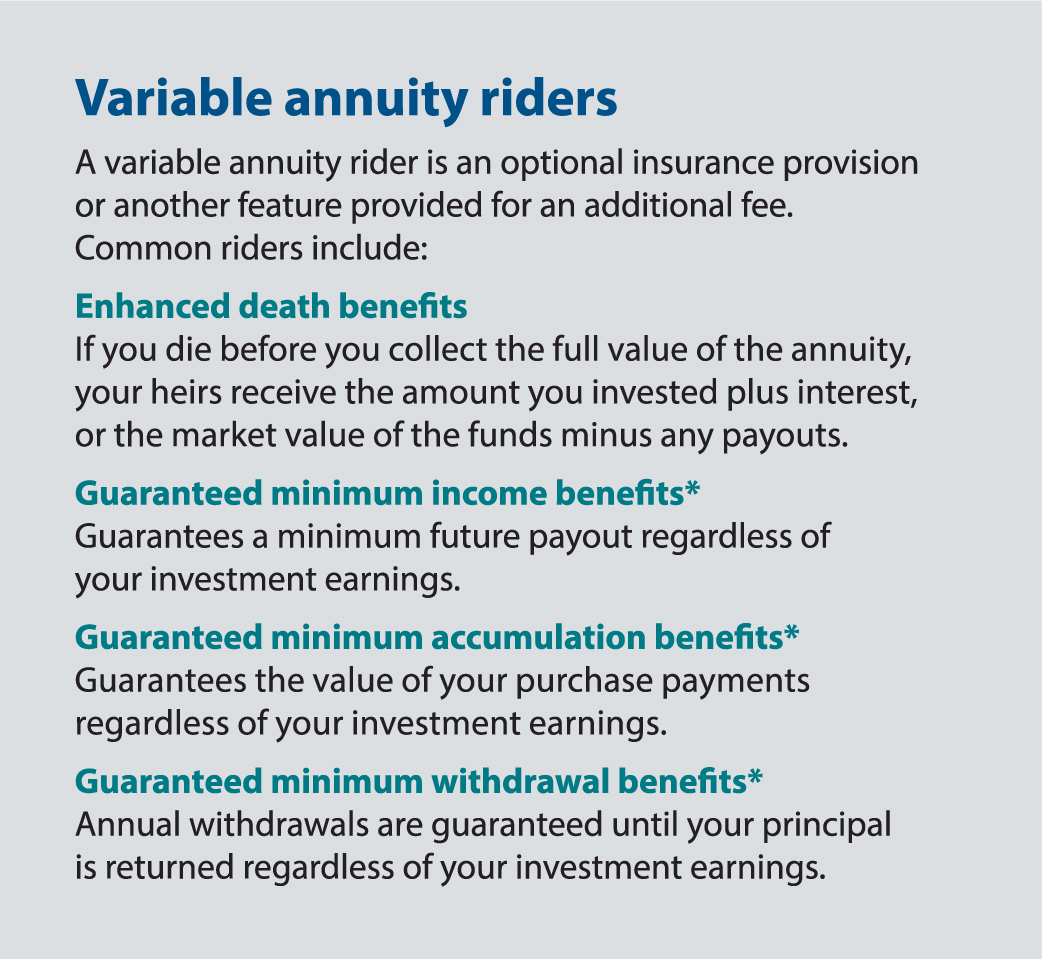

Just like all financial investments, there is potential for threats with a variable price annuity.

Table of Contents

Latest Posts

Decoding What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Variable Vs Fixed Annuity Defining the Right Financial Strategy Benefits of Fixed Annuity Vs Variable Annuity Why Fixed Annu

Highlighting What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing the Ri

Highlighting Fixed Annuity Vs Variable Annuity Key Insights on Fixed Vs Variable Annuity Pros Cons Breaking Down the Basics of Variable Annuity Vs Fixed Indexed Annuity Benefits of Choosing the Right

More

Latest Posts