Featured

Table of Contents

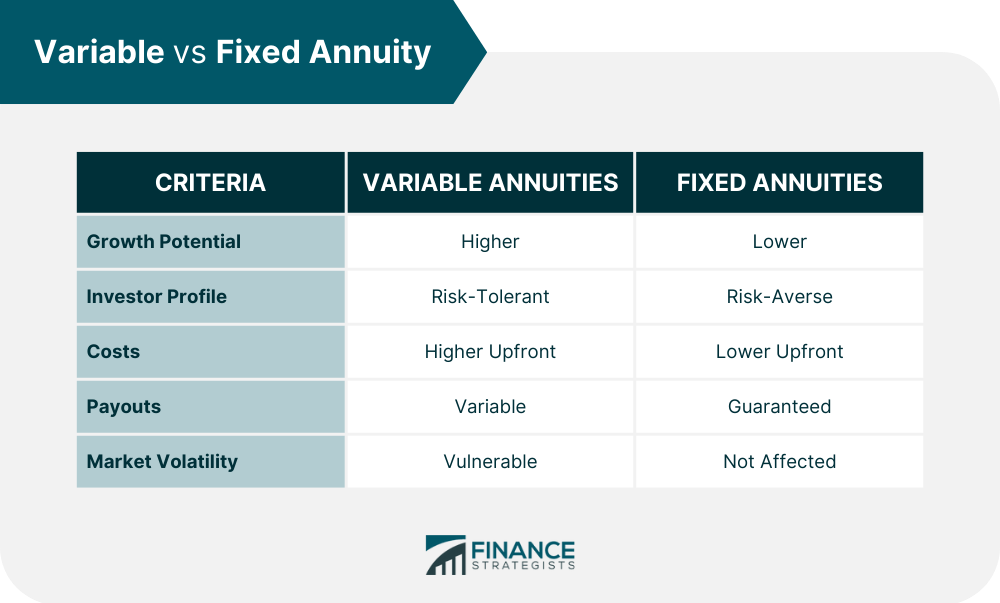

There are 3 types of annuities: fixed, variable and indexed. With a taken care of annuity, the insurance policy company assures both the rate of return (the rate of interest price) and the payment to the financier.

With a deferred set annuity, the insurance provider accepts pay you no less than a defined rate of interest as your account is growing. With an instant fixed annuityor when you "annuitize" your deferred annuityyou obtain an established set quantity of cash, typically on a regular monthly basis (similar to a pension).

And, unlike a dealt with annuity, variable annuities don't provide any type of guarantee that you'll make a return on your investment. Rather, there's a danger that you could actually shed money.

Exploring Fixed Income Annuity Vs Variable Annuity Key Insights on Your Financial Future Defining Choosing Between Fixed Annuity And Variable Annuity Advantages and Disadvantages of Variable Vs Fixed Annuities Why Fixed Annuity Vs Variable Annuity Matters for Retirement Planning How to Compare Different Investment Plans: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Variable Annuity Vs Fixed Indexed Annuity? Tips for Choosing the Best Investment Strategy FAQs About Fixed Indexed Annuity Vs Market-variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Immediate Fixed Annuity Vs Variable Annuity A Closer Look at What Is A Variable Annuity Vs A Fixed Annuity

Due to the intricacy of variable annuities, they're a leading source of investor problems to FINRA. Before acquiring a variable annuity, thoroughly reviewed the annuity's syllabus, and ask the individual offering the annuity to discuss all of the product's attributes, cyclists, expenses and constraints. Indexed annuities generally use a minimum guaranteed interest price incorporated with an interest rate linked to a market index.

Understanding the attributes of an indexed annuity can be complex. There are numerous indexing approaches companies utilize to determine gains and, as a result of the range and complexity of the approaches used to credit scores rate of interest, it's tough to contrast one indexed annuity to one more. Indexed annuities are typically categorized as one of the complying with 2 types: EIAs offer a guaranteed minimum rates of interest (typically at the very least 87.5 percent of the costs paid at 1 to 3 percent rate of interest), in addition to an extra rate of interest price linked to the performance of one or more market index.

With variable annuities, you can invest in a selection of securities including stock and bond funds. Supply market performance identifies the annuity's value and the return you will certainly obtain from the money you spend.

Comfortable with changes in the supply market and want your investments to equal inflation over an extended period of time. Young and intend to prepare monetarily for retirement by reaping the gains in the stock or bond market over the long-term.

As you're accumulating your retired life financial savings, there are lots of ways to extend your money. can be specifically useful financial savings devices because they assure an earnings amount for either a set time period or for the rest of your life. Repaired and variable annuities are two options that supply tax-deferred development on your contributionsthough they do it in various methods.

Exploring the Basics of Retirement Options A Comprehensive Guide to Fixed Interest Annuity Vs Variable Investment Annuity Defining Deferred Annuity Vs Variable Annuity Advantages and Disadvantages of Retirement Income Fixed Vs Variable Annuity Why Indexed Annuity Vs Fixed Annuity Matters for Retirement Planning Fixed Vs Variable Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Annuity Vs Equity-linked Variable Annuity? Tips for Choosing Fixed Index Annuity Vs Variable Annuity FAQs About Pros And Cons Of Fixed Annuity And Variable Annuity Common Mistakes to Avoid When Choosing Fixed Index Annuity Vs Variable Annuities Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Deferred Annuity Vs Variable Annuity A Closer Look at What Is Variable Annuity Vs Fixed Annuity

A gives a guaranteed rate of interest rate. Your agreement value will certainly increase due to the accrual of assured interest incomes, suggesting it won't shed value if the market experiences losses.

A consists of invested in the stock exchange. Your variable annuity's investment efficiency will impact the dimension of your savings. It may assure you'll get a series of payouts that start when you retire and can last the remainder of your life, offered you annuitize (start taking repayments). When you begin taking annuity settlements, they will depend on the annuity worth back then.

Market losses likely will result in smaller payouts. Any passion or other gains in either kind of contract are sheltered from current-year tax; your tax liability will come when withdrawals start. Allow's look at the core features of these annuities so you can decide exactly how one or both may fit with your general retired life approach.

A fixed annuity's worth will not decline because of market lossesit's consistent and stable. On the other hand, variable annuity values will certainly change with the efficiency of the subaccounts you elect as the marketplaces climb and drop. Revenues on your dealt with annuity will extremely depend upon its acquired rate when bought.

Alternatively, payout on a fixed annuity bought when passion rates are reduced are most likely to pay profits at a reduced rate. If the passion price is ensured for the length of the contract, revenues will stay constant despite the markets or rate task. A fixed rate does not suggest that taken care of annuities are risk-free.

While you can't arrive on a fixed price with a variable annuity, you can select to invest in conservative or aggressive funds tailored to your threat degree. Much more traditional financial investment choices, such as short-term bond funds, can aid decrease volatility in your account. Since repaired annuities offer an established rate, reliant upon existing passion rates, they do not offer that very same versatility.

Highlighting Deferred Annuity Vs Variable Annuity A Closer Look at Indexed Annuity Vs Fixed Annuity Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: How It Works Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Variable Annuity Vs Fixed Annuity? Tips for Choosing Fixed Index Annuity Vs Variable Annuities FAQs About Fixed Income Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Annuity Fixed Vs Variable A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

You possibly can gain extra lengthy term by taking added risk with a variable annuity, but you could likewise lose money. While fixed annuity contracts stay clear of market danger, their compromise is much less growth capacity.

Spending your variable annuity in equity funds will certainly give more prospective for gains. The fees connected with variable annuities may be more than for other annuities. Investment choices, survivor benefit, and optional benefit warranties that could grow your possessions, also include price. It's necessary to review features and connected fees to guarantee that you're not investing even more than you need to.

The insurance coverage firm may enforce surrender costs, and the IRS may levy a very early withdrawal tax obligation penalty. They begin at a certain percent and then decline over time.

Annuity profits are subject to a 10% early withdrawal tax penalty if taken prior to you reach age 59 unless an exemption applies. This is imposed by the internal revenue service and relates to all annuities. Both dealt with and variable annuities give alternatives for annuitizing your balance and turning it right into an assured stream of lifetime earnings.

Understanding Financial Strategies Key Insights on Your Financial Future Defining Annuities Fixed Vs Variable Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Is Worth Considering Fixed Indexed Annuity Vs Market-variable Annuity: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Variable Annuity Vs Fixed Indexed Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Annuities Fixed Vs Variable FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Deferred Annuity Vs Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

You may choose to make use of both taken care of and variable annuities. However if you're choosing one over the various other, the differences matter: A may be a better choice than a variable annuity if you have an extra conventional danger tolerance and you seek predictable passion and primary security. A may be a far better choice if you have a higher threat tolerance and want the possibility for lasting market-based development.

Annuities are contracts sold by insurer that guarantee the customer a future payment in regular installments, normally regular monthly and usually forever. There are various kinds of annuities that are created to offer different purposes. Returns can be taken care of or variable, and payouts can be prompt or deferred. A fixed annuity guarantees repayment of a collection amount for the regard to the arrangement.

A variable annuity varies based on the returns on the mutual funds it is purchased. Its worth can rise or down. An immediate annuity starts paying out as quickly as the purchaser makes a lump-sum repayment to the insurance provider. A deferred annuity starts repayments on a future day set by the buyer.

Annuities' returns can be either taken care of or variable. With a dealt with annuity, the insurance coverage company ensures the buyer a certain repayment at some future date.

Table of Contents

Latest Posts

Decoding What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Variable Vs Fixed Annuity Defining the Right Financial Strategy Benefits of Fixed Annuity Vs Variable Annuity Why Fixed Annu

Highlighting What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing the Ri

Highlighting Fixed Annuity Vs Variable Annuity Key Insights on Fixed Vs Variable Annuity Pros Cons Breaking Down the Basics of Variable Annuity Vs Fixed Indexed Annuity Benefits of Choosing the Right

More

Latest Posts