Featured

Table of Contents

Trustees can be family participants, relied on individuals, or monetary organizations, depending on your choices and the intricacy of the trust fund. The goal is to ensure that the trust fund is well-funded to fulfill the child's long-lasting monetary demands.

The role of a in a youngster assistance depend on can not be downplayed. The trustee is the specific or company in charge of managing the count on's possessions and guaranteeing that funds are distributed according to the terms of the count on arrangement. This includes seeing to it that funds are utilized entirely for the child's benefit whether that's for education and learning, healthcare, or day-to-day expenditures.

They should additionally supply normal records to the court, the custodial moms and dad, or both, depending upon the regards to the count on. This liability makes sure that the trust is being taken care of in a manner that benefits the kid, protecting against abuse of the funds. The trustee additionally has a fiduciary responsibility, indicating they are lawfully bound to act in the best rate of interest of the youngster.

By purchasing an annuity, parents can make sure that a fixed quantity is paid frequently, regardless of any type of variations in their revenue. This offers tranquility of mind, understanding that the kid's requirements will continue to be fulfilled, regardless of the monetary circumstances. One of the key advantages of using annuities for youngster support is that they can bypass the probate process.

How do I apply for an Annuities For Retirement Planning?

Annuities can likewise offer security from market fluctuations, ensuring that the child's financial backing stays stable even in unstable economic conditions. Annuities for Youngster Support: A Structured Option When establishing, it's essential to take into consideration the tax obligation effects for both the paying parent and the youngster. Counts on, depending on their structure, can have different tax therapies.

In other instances, the recipient the kid might be in charge of paying taxes on any kind of distributions they get. can likewise have tax ramifications. While annuities supply a secure income stream, it is essential to understand just how that revenue will certainly be exhausted. Depending upon the framework of the annuity, repayments to the custodial parent or child may be thought about gross income.

Among the most substantial benefits of utilizing is the ability to secure a kid's monetary future. Trusts, particularly, offer a level of defense from creditors and can ensure that funds are made use of properly. A depend on can be structured to make sure that funds are only made use of for specific purposes, such as education or healthcare, avoiding abuse.

What are the top Variable Annuities providers in my area?

No, a Texas youngster support trust fund is particularly created to cover the child's necessary demands, such as education, medical care, and daily living expenses. The trustee is lawfully obliged to guarantee that the funds are utilized solely for the advantage of the kid as outlined in the trust contract. An annuity provides structured, foreseeable repayments with time, ensuring consistent financial backing for the kid.

Yes, both kid assistance trust funds and annuities come with potential tax effects. Depend on earnings might be taxed, and annuity settlements could additionally be subject to tax obligations, relying on their structure. It's crucial to talk to a tax obligation professional or economic expert to recognize the tax obligation obligations related to these economic devices.

How can an Income Protection Annuities protect my retirement?

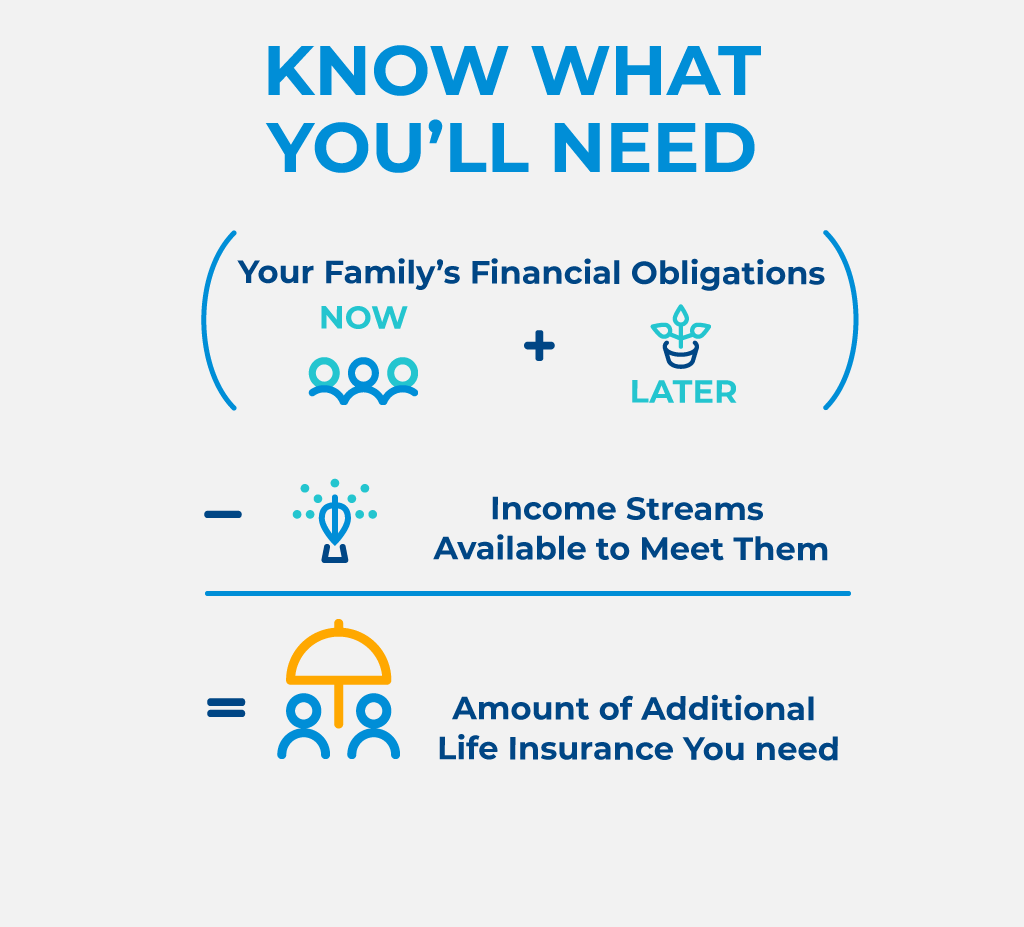

Download this PDF - Sight all Publications The elderly person populace is big, growing, and by some estimates, hold two-thirds of the private wealth in the United States. By the year 2050, the variety of seniors is projected to be almost two times as large as it remained in 2012. Since numerous elders have actually had the ability to save up a savings for their retired life years, they are typically targeted with fraud in such a way that younger individuals without any cost savings are not.

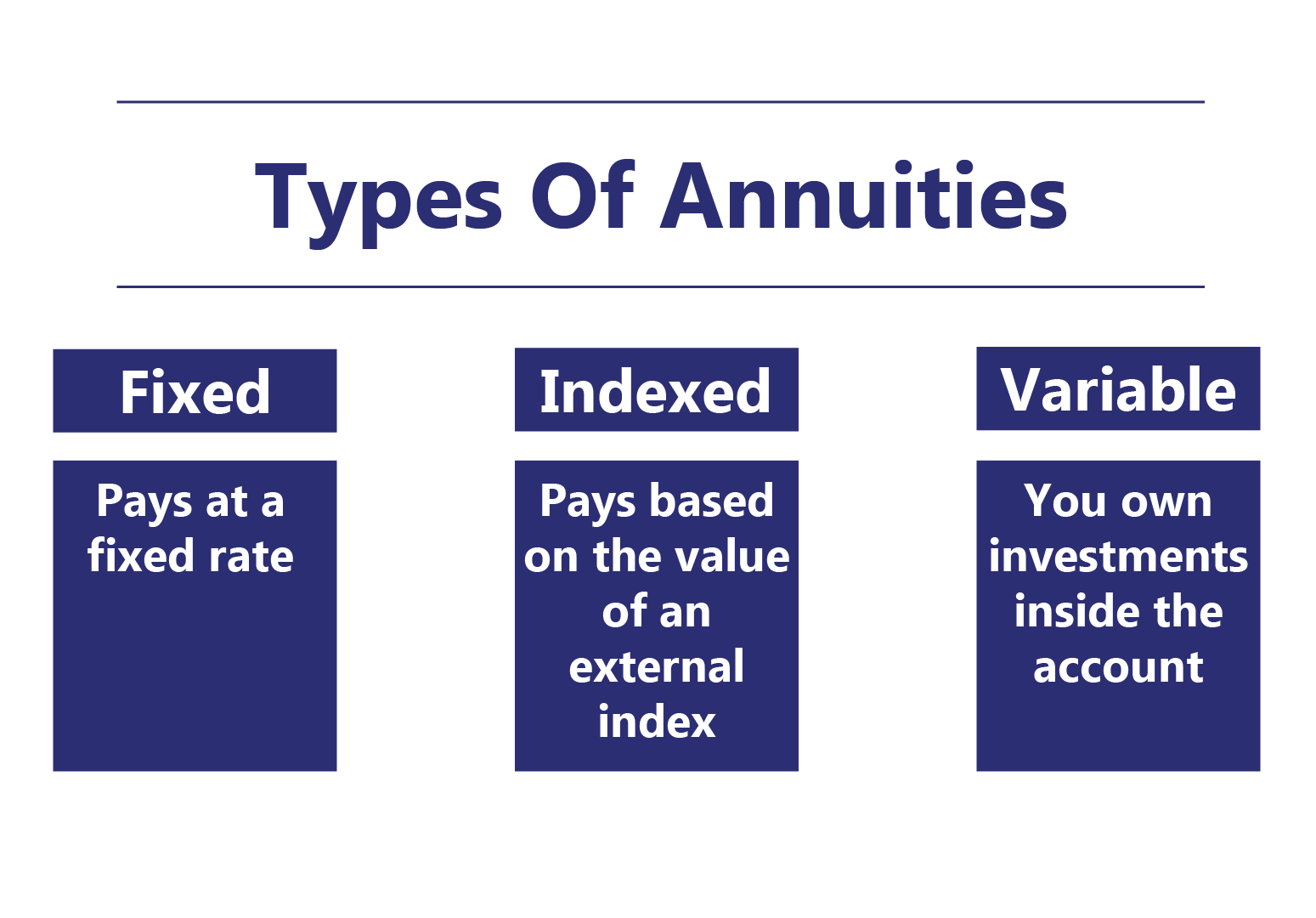

In this setting, customers should equip themselves with details to protect their passions. The Attorney general of the United States supplies the complying with ideas to consider before acquiring an annuity: Annuities are challenging investments. Some bear complex high qualities of both insurance and safety and securities items. Annuities can be structured as variable annuities, dealt with annuities, prompt annuities, postponed annuities, and so on.

Consumers must read and comprehend the program, and the volatility of each investment noted in the syllabus. Financiers must ask their broker to discuss all terms in the syllabus, and ask questions regarding anything they do not recognize. Dealt with annuity items might additionally bring threats, such as lasting deferral periods, barring investors from accessing every one of their cash.

The Chief law officer has filed suits against insurance provider that sold inappropriate deferred annuities with over 15 year deferral periods to investors not expected to live that long, or who require accessibility to their money for healthcare or helped living costs (Guaranteed income annuities). Capitalists ought to make sure they recognize the lasting repercussions of any annuity purchase

What should I look for in an Annuity Withdrawal Options plan?

The most significant charge linked with annuities is frequently the surrender charge. This is the percentage that a customer is billed if he or she takes out funds early.

Customers might wish to get in touch with a tax professional before spending in an annuity. Furthermore, the "security" of the investment relies on the annuity. Be cautious of agents who strongly market annuities as being as risk-free as or much better than CDs. The SEC warns customers that some vendors of annuities products prompt consumers to switch over to another annuity, a practice called "spinning." Unfortunately, representatives may not appropriately divulge fees associated with switching investments, such as new surrender charges (which generally start over from the date the item is switched), or considerably altered advantages.

Representatives and insurer may provide perks to entice investors, such as extra passion factors on their return. The advantages of such "rewards" are commonly surpassed by boosted fees and administrative costs to the capitalist. "Rewards" may be just marketing gimmicks. Some deceitful representatives urge consumers to make unrealistic investments they can not pay for, or get a long-lasting deferred annuity, although they will require access to their money for health and wellness care or living expenditures.

This section gives details valuable to senior citizens and their family members. There are numerous events that may impact your benefits. Provides info often asked for by brand-new retirees consisting of altering health and wellness and life insurance options, Soda pops, annuity repayments, and taxed sections of annuity. Explains exactly how benefits are influenced by events such as marriage, divorce, death of a partner, re-employment in Federal service, or failure to handle one's financial resources.

What does a basic Immediate Annuities plan include?

Trick Takeaways The beneficiary of an annuity is a person or organization the annuity's owner assigns to get the contract's death advantage. Different annuities pay out to beneficiaries in different ways. Some annuities may pay the beneficiary stable payments after the agreement holder's fatality, while various other annuities might pay a fatality advantage as a round figure.

Table of Contents

Latest Posts

Decoding What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Variable Vs Fixed Annuity Defining the Right Financial Strategy Benefits of Fixed Annuity Vs Variable Annuity Why Fixed Annu

Highlighting What Is Variable Annuity Vs Fixed Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choosing the Ri

Highlighting Fixed Annuity Vs Variable Annuity Key Insights on Fixed Vs Variable Annuity Pros Cons Breaking Down the Basics of Variable Annuity Vs Fixed Indexed Annuity Benefits of Choosing the Right

More

Latest Posts